Exchanges of Assets for Assets Have What Effect on Equity

If I stuff my mattress with cash USD I am holding a monetary asset. Revenues expenses gains and distributions to owners.

Private Equity Has Better Returns Lower Volatility Than Public Markets Will The Sec Make It Easier For Retail Investors To Gain Access To This Asset Class Business Capital Private Equity

Companies need long term fixed assets land building and vehicles etc to carry out various business activities.

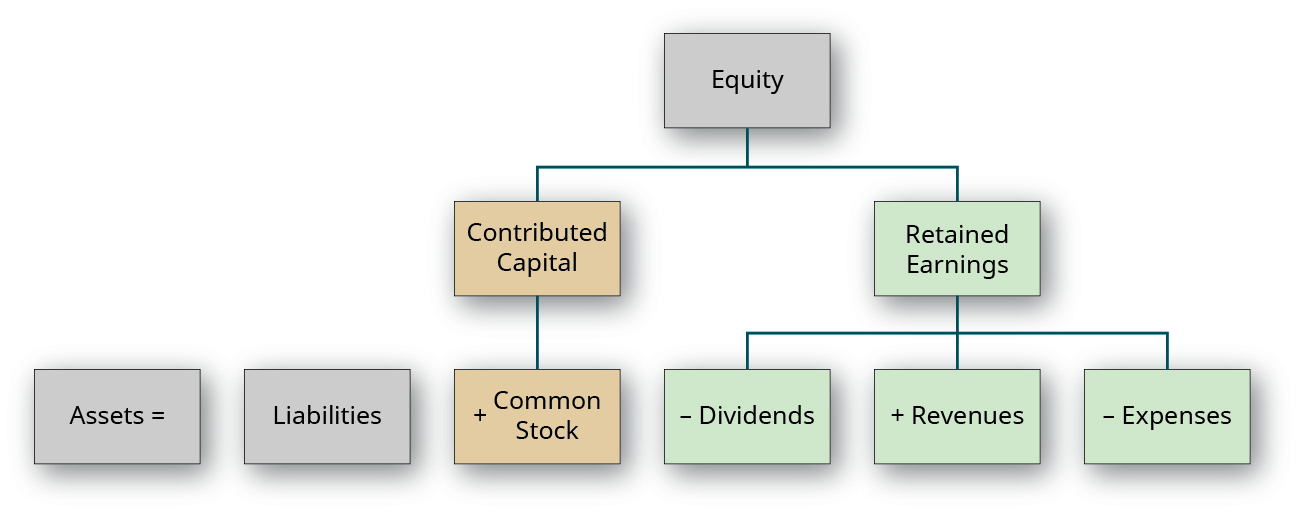

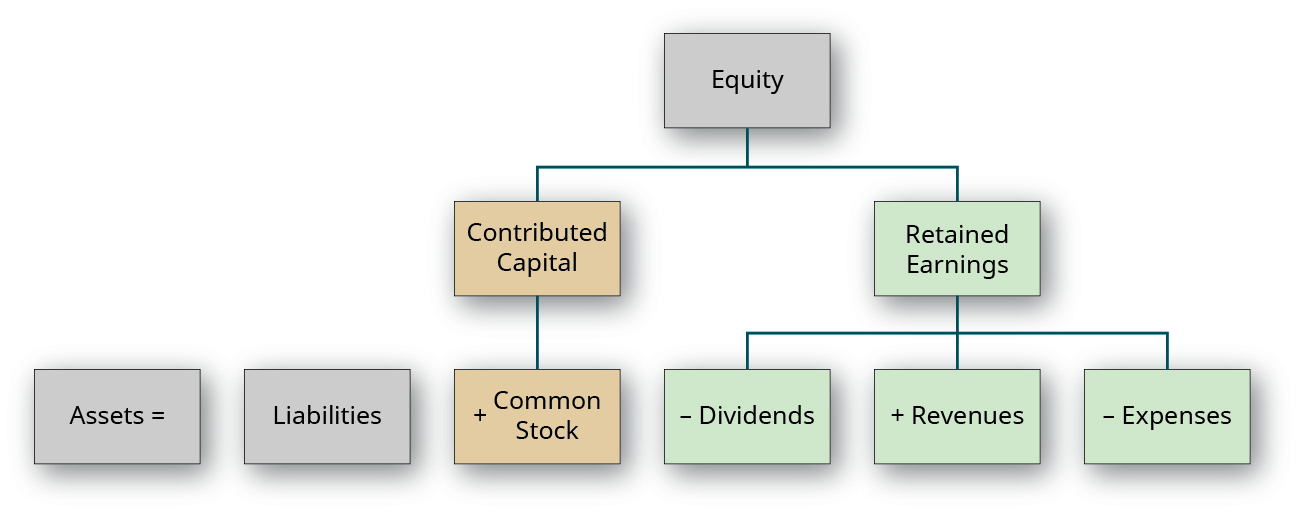

. Retained earnings are considered part of owners equity which stands for the claim that a businesss owners have on its assets after all liabilities are deducted. Equity is made up of contributed capital Contributed Capital Contributed capital is the amount that shareholders have given to the company for buying their stake and is recorded in the books of accounts as the common stock and additional paid-in capital under the equity section of the companys. Exchanges of assets for assets.

However private equity funds often come with steep restrictions on. One way to acquire these assets is to purchase them for cash from the market and another way is to acquire them in exchange of companys stock. Selling selling close to our customers.

If I hold physical silver then I have a commodity asset. The result could be quite different if the asset was sold for cash. There is no relationship between assets and equity.

Issuing stock for non-cash tangible and intangible. We are Were very very willing to dealing the business off. Whatever the motivation behind the transaction the accountant is.

Exchanges of assets for assets have what effect on equityA. All exchange differences are recognised in a separate component of equity. If you can invest in private equity assets like venture capital or funds of funds you have the potential to achieve big gains.

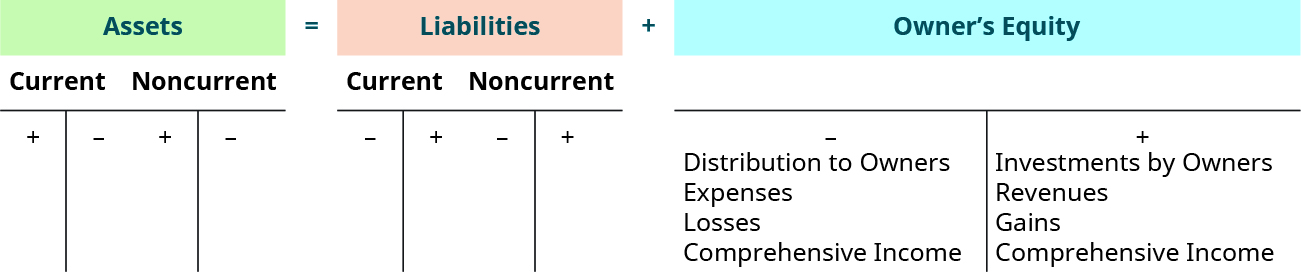

Key Differences Between Equity and Assets. Exchanges of assets for assets have what effect on equity. Assets liabilities and owners equity.

Exchanges of liabilities for liabilities. I forgot one other kind of asset. Okay so lets understand the current solution.

LO 22 Exchanges of assets for assets have what effect on equity. Since depreciation is an important expense on the income statement it impacts owners equity through net income which in turn impacts retained earnings. May have no impact on equityC.

There is no relationship between assets and equity. But given keys first of all people right over BC counting Grishin and from the F B. Intangible assets such as intellectual property require a separate assignment.

Assets Liabilities Equity. There is no relationship between assets and equity. There is no relationship between assets and equity.

Exchanges of assets for assets have what effect on equity. Assets liabilities and investments by owners. Any change in assets affects equity.

Assets 36000 in cash 4000 in equipment MacBooks Liabilities 10000 in loans Equity 30000 in stock you and Anne A few days later you buy the standing desks causing your cash account to go down by 10000 and your equipment account to go up by 10000. Then your accounting equation is. This means that if your total asset needs adds up to 200000 and you get 100000 from debt and 100000 from equity.

Issuing stock for non-cash assets. Exchanges can be motivated by tax rules because neither company may be required to recognize a taxable event on the exchange. But I dont need a level you know.

All currencies other than the functional one are treated as foreign currencies. Acquisitions of assets by incurring liabilities. An entity does not have a choice of functional currency.

The accounting equation for your company now looks like this. Equities commodities and debts are the three kinds of assets that a person can hold. By this I mean your liability equity must equal your total assets.

Well start with the institution. It is important to understand the inseparable connection between the elements of the financial statements and the possible impact on organizational equity value. Most tangible assets such as equipment may easily be transferred by a bill of sale or other instrument of title.

At the entity level management should determine the functional currency of the entity based on the requirements of IAS 21. There is no relationship between assets and equity. Rises in sales accounts receivable money that the company is owed but has not received property and equipment values cash and cash equivalents for example increases shareholder equity assuming that the liabilities remain constant.

An asset sale can be more complex and time-consuming than an equity sale because of the need to identify and transfer each important asset. No impact on equity. If I hold the stock of an individual company then I have an equity asset.

May have no impact on equity. May have no impact on equity. Assets 26000 in cash.

Settlements of liabilities by transferring assets. Next the replacement property must be secured and the exchange finalized no later than 180 days after the sale of the original asset or the deadline of the income tax return for the tax year the.

We Put Shareholders Vs Stakeholders As Owners Vs Any Parties Interested In The Company Note T Accounting Education Accounting And Finance Learn Accounting

Advantages And Disadvantages Of Leasing Lease Accounting Basics Financial Strategies

Define And Describe The Expanded Accounting Equation And Its Relationship To Analyzing Transactions Principles Of Accounting Volume 1 Financial Accounting

Accounting Basics Purchase Of Assets Accountingcoach

Statement Of Changes In Equity Purpose Examples Video Lesson Transcript Study Com

Balance Sheet Formula Accounting Education Investing Accounts Payable

Accounting Equation Accounting Corner

A Financial Market Is The System Through Which Financial Assets Are Negotiated It S Made By Exchanges B Financial Markets Financial Instrument Financial Asset

Philippines The Pinai Fund Visual Ly Private Equity Accounting And Finance Investing

Business Risk Vs Financial Risk All You Need To Know In 2021 Business Risk Financial Management Financial

Liquid Assets Learn Accounting Accounting Education Bookkeeping Business

Differences Between Assets And Liabilities Liability Asset Intangible Asset

Value Of A Firm Economics Lessons Finance Investing Business Analysis

/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Definition Formula Examples

Asset Classes The Big Picture Portfolio Management Finance Class Modern Portfolio Theory

Define Explain And Provide Examples Of Current And Noncurrent Assets Current And Noncurrent Liabilities Equity Revenues And Expenses Principles Of Accounting Volume 1 Financial Accounting

The Report Released Recently By Prequin Shows How Institutional Investors Are Increasing Their Allocations To Alternative Private Equity Equity Infrastructure

How Is Cross Chain Defi Achieved On Horizon Protocol 04 Cross Chain Horizons Volatility Index

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)

Comments

Post a Comment